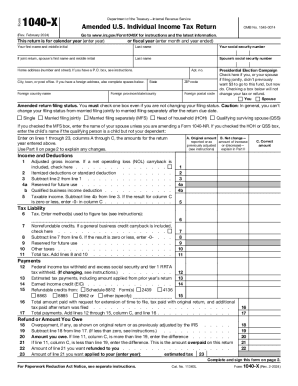

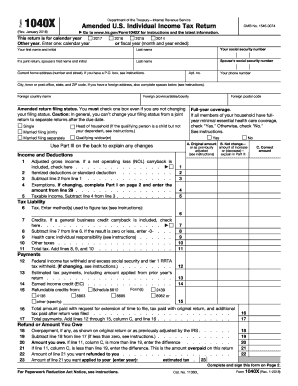

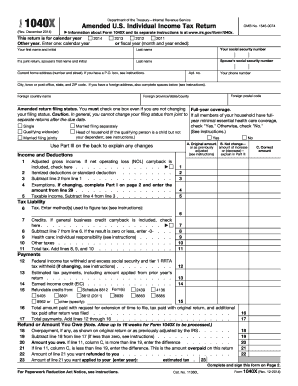

IRS 1040-X 2003 free printable template

Instructions and Help about IRS 1040-X

How to edit IRS 1040-X

How to fill out IRS 1040-X

About IRS 1040-X previous version

What is IRS 1040-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-X

How do I modify my [SKS] in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your [SKS] and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for signing my [SKS] in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your [SKS] and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the [SKS] form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign [SKS] and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

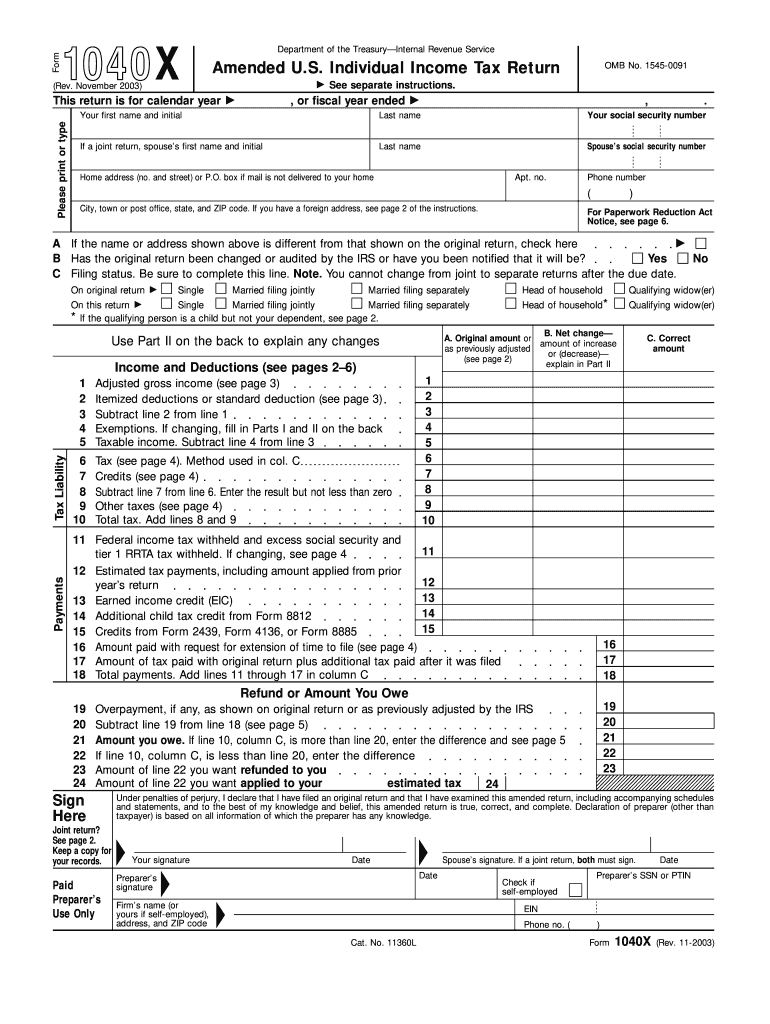

What is IRS 1040-X?

IRS 1040-X is the Amended U.S. Individual Income Tax Return form used to correct errors on a previously filed 1040 form.

Who is required to file IRS 1040-X?

Anyone who needs to amend a previously filed individual income tax return to correct mistakes, claim additional deductions or credits, or change filing status is required to file IRS 1040-X.

How to fill out IRS 1040-X?

To fill out IRS 1040-X, obtain the form from the IRS website, provide your personal information, indicate the tax year, outline the changes being made, explain the reason for the amendments, and sign the form before submitting it.

What is the purpose of IRS 1040-X?

The purpose of IRS 1040-X is to allow taxpayers to correct errors made on their original tax returns, ensuring accurate tax reporting and proper handling of tax liabilities.

What information must be reported on IRS 1040-X?

IRS 1040-X must include personal information such as your name, address, and Social Security number, as well as details of your original return, the changes being made, and the reason for those changes.

See what our users say